On Google Ads, your competitors are very visible.

Every time you search for something related to your products, your competitors’ ads are right there, staring you in the face.

A common urge I see with many business owners is want to get their ads on top of their competitors.

But that’s not always a good strategy. At least, not if you want to run profitable campaigns.

Because from the outside, you have no idea whether your competitors are actually making any money from those ads. Even if they’ve been running them for many months or years, it doesn’t mean a thing. (Trust me, I’ve seen the insides of hundreds of Google Ad accounts and can testify to this.)

So if you want to spend more to outrank your competitors, or just get started with Google Ads, it’s good to have a little more information.

How much are they spending? What keywords are they advertising on? And how profitable are they?

Of course, your competitors want to keep all of this information hidden. Heck, they might even be embarrassed about the amount of money they are throwing away.

But luckily for you, they can’t hide everything.

In this article, I’ll show you how with a little bit of time and the right tools, you can get find out what your Google Ads competitors are exactly doing.

Google Ads Guide For Ecommerce

Get our FREE 59 page guide on how to start and scale your Google Ads campaigns!Download your copy

Key Competitor Insights

Most people immediately start with the tools. This matters, but it’s more important to decide what we’re actually trying to find out.

To me these are the most interesting questions:

- Which competitors are advertising on Google Ads?

- How much traffic do they get?

- How much are they paying for these visitors?

- What are their most popular keywords?

- What do their most important metrics look like? (Revenue, AOV, CAC & LTV?)

In what follows I’ll show you how to find this information.

1. Which competitors are using Google Ads?

The easiest way to discover who is advertising on Google Ads is to just search for a couple of keywords and see which advertisers show up.

That’s a good start, but know that this approach might only show part of the playing field:

- Geography & language: the results are limited to the location and language of your browser

- Keywords: you need to have some clue of their keywords

- Schedule: advertisers can configure their ads to only show during certain times. So repeat your search at different times of the day and days of the week.

- Ad budget: Their budget might be exhausted, causing them not to show for that time of the day

For the advertisers that show up, you can take a look at their numbers with a tool called Similarweb.

Google Ads Auction Insights

If you are already running Google Ads campaigns, you can more detailed information from the Google Ads Auction Insights report. This report will tell you how you compare to other advertisers for your whole account, a specific campaign or a specific ad group.

The great thing with this method is that you get a pretty clear picture of which advertisers you’re competing with and how aggressive they are.

Here is a look at the Auction Insights report for a campaign of one of my clients:

In the first column of the table, you can see all the other advertisers, I’ve blurred most out for confidentiality but you can see a couple of big stores like Amazon and Target.

If your report shows these type of big competitors, don’t be scared off. It is possible to compete against these giants if you do things right.

But because these businesses operate pretty differently than you are, I’ll leave them out of the research. If we’re looking for actionable information that you can use in our campaigns and business, so you need competitors that sell similar items to what you sell.

If you sell outdoor furniture, you need to look into other outdoor furniture stores, not a store like Walmart which sells a bit of everything.

Note that if you’re looking at this report for a Google Shopping campaign, the number of columns will be limited.

Google Ads Guide For Ecommerce

Get our FREE 59 page guide on how to start and scale your Google Ads campaigns!Download your copy

2. How much Google Ads traffic do your competitors get?

As I have shown you above, my goto tool to find traffic numbers for any website used to be Similarweb.

Unfortunately, they don’t show that info anymore for a lot of sites? Especially for smaller ones, you’ll often see the following:

My guess is that some of their estimates weren’t 100% so they cut some unreliable data sources.

But although Similarweb doesn’t always show the actual number of visitors, knowing the split between the different traffic sources can be valuable. You can compare and see where your own traffic comes from.

Let say an advertiser gets 2000 visitors/month via organic search, and that’s 50% of their traffic. If they look at that traffic sources report for one of their competitors and see they get 75% through organic search, it could mean there is potential in this channel.

But a lot of that is guestimating and speculating, let’s see how we can find the actual traffic numbers.

A) If you’re running Google Ads Campaigns

If you’re running Google Ads campaign, the Auction Insights I’ve mentioned above are a great source of information:

You can see Dominant Danny, amazon.com, You (my client), target.com & Lagging Larry.

Out of all the data in this table, these are the most important metrics:

- Impression share: what percentage of the time did this advertiser show up vs all the potential impressions?

- Outranking share: what percentage of the time did this advertiser outrank my client?

Let’s take a look at some specifics:

Dominant Danny has the highest Impression Share of all advertisers with these same set of keywords. This store is showing up in 82% of all searches while my client only shows 35% of the time.

Very rough math means that if my client could get to that level of traffic, we would be looking at 2.5x the clicks and 2.5x cost and potentially 2.5x the revenue.

The reasons for a low Impression Share can be a lower ad budget, lower max CPCs or lower quality scores.

B) If you’re running NOT Google Ads Campaigns

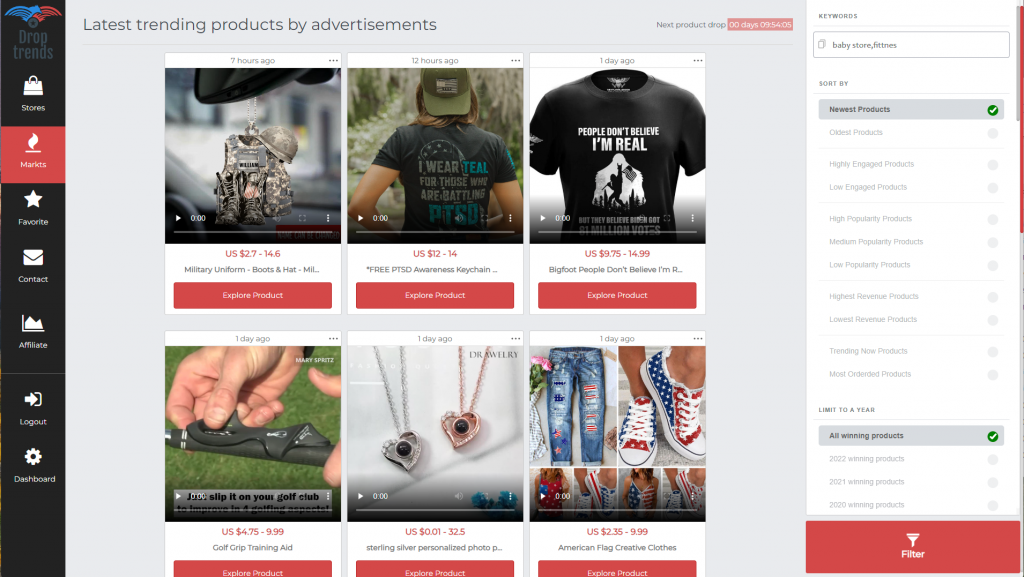

There are a ton of keyword/PPC tools that specialize in giving this competitive research information.

These will give you the number of keywords that a business is advertising on, how much traffic that drives and what that cost.

because there are many tools out there that look similar, I decided to run a quick test to test their usefulness and accuracy. I compared a US-based client’s data to the results from these tools.

Here is what that looked like:

These aren’t great results. Of the 5 tools that I tested, only SpyFu came close.

I know that the results from these types of tools can vary wildly depending on which website you are researching. I’m guessing that bigger accounts will also have more accurate data.

But if you’re interested in any of these tools, scroll to the end of the article where I’ve included a bit more info on each tool.

Google Ads Guide For Ecommerce

Get our FREE 59 page guide on how to start and scale your Google Ads campaigns!Download your copy

3. What are your competitors’ top keywords?

Here is where you are at. You know:

- Which competitors are advertising on Google Ads

- How much traffic do they get?

- A rough estimate of how much they are spending.

Now it’s time to dig a little deeper and discover the Google Ads keywords that your competitors are advertising on.

The tools I’ve mentioned before can help you to find the keywords and the traffic they get from them.

Here is a report I pulled from Semrush while researching Allbirds:

It starts with the basics: which keywords, the monthly search volumes and their estimated CPCs. The last two columns give you more insights into the role of a specific keyword for an advertiser.

The traffic % and cost % allow you to quickly focus on the most important keywords.

Knowing which keywords are most popular for a brand is interesting. But it would be even more interesting to know how profitable these keywords are.

Here is my rule of thumb, from most to least profitable keywords:

- Type 1: Store brand keywords: searches for the store’s name

- Type 2: 3rd-party branded keywords: searches for the brands and products that a store sells

- Type 3: specific non-branded keywords: detailed searches for products

- Type 4: general non-branded keywords: very broad category searches

As I said, the most profitable searches in any account are those for the store’s brand. These branded keywords have an ROI of 50-300x. Many stores are hesitant to advertise on them, but the cost is so low that they often are a good investment.

But this can also work if you’re competing with that brand.

If you see a competitor with a large amount of branded keywords, you could try to set up a campaign to target these competitor searches with your ads. While it’s easy to steal clicks in this way, the orders don’t often follow.

It can work for some brands, but in most cases, competitor branded keywords are out of reach.

A better approach is to try and discover the type 2 and type 3 keywords from a competitor.

Try to see which on which products and brands they are advertising on. And how long they’ve been advertising on them.

That’s a good start to judge the profitability of a keyword. But as I said before, this logic doesn’t always hold up. Some advertisers will continue to plow money into unprofitable keywords for many years.

Let’s take a look at a couple of specific tools to see how they can help with the research.

Similarweb

In Similarweb, you can actually get the % split of branded traffic, with the actual keywords.

SEMrush

SEMrush has a report which gives a pretty solid overview of the keywords, traffic volume, and percentage of all traffic.

Checking again for my client, the number keywords is off, but SEMrush manages to identify almost all of the most trafficked ones.

Ahrefs

Ahrefs has a very similar keyword overview and their numbers are in the same ballpark as SEMrush. The biggest issue is that Ahrefs attributes even fewer keywords, only 25 vs the 146 active ones we have in the account.

iSpionage

iSpionage has an interesting report with the most profitable keywords.

The top 3 keywords it surfaced for this client are indeed amongst the more profitable ones and not just the ones with the most traffic.

SpyFu

As part of SpyFu it has a built-in Google Ads advisor where it tells not only what’s happening but also what you should do.

Here is a report with some keywords suggestions that are missing for this client but that other advertisers are using.

So while there is no single tool that you can use for all your needs, crosschecking a couple of sites in the different tools will give you a good idea about the most interesting keywords, their popularity, and search volumes.

Google Ads Guide For Ecommerce

Get our FREE 59 page guide on how to start and scale your Google Ads campaigns!Download your copy

4. How much money are your competitors making from Google Ads?

Here is where Google Ads gets complicated (and very interesting!). If two advertisers sell the exact same products, run the exact same campaigns, ads, and keywords, the results can still be different.

Especially in bigger accounts (with budgets over $5k/month), the foundational parts become essential to succeed.

A lot of it has to do with how effective the website is at selling and how well it can convince buyers to purchase again.

Let’s say Advertiser A has a conversion rate of 3% while Advertiser B is 1.5%. If everything else stays the same, Advertiser A will be able to bid a lot more for each click than Advertiser B.

It’s a very simple example but already shows how the impact of the underlying metrics on the Google Ads performance. Here are the most important metrics:

- Monthly revenue

- Conversion rate

- Average order value

- Customer acquisition cost

- Repurchase rate

- Customer lifetime value

Obviously, these are valuable metrics that most companies like to keep under wraps.

And I have yet to encounter a tool that will show me these metrics, so here are my (creative) tips to get them.

Google rep

I used to be an official Google Partner and as part of this program, I had a Google rep I can call when I need input for new clients or campaigns.

The higher the budget of the (potential) client, the more info they’ll provide.

So for a new client, I was able to get the customer acquisition cost of the top 5 players in their industry. the data was anonymized but still. Since my client had been advertising in this market before, we had a pretty good idea about the cost per click, which allowed us to work backward and figure out the revenue numbers for all of these players.

This really helped us to put together a list of targets to guide our optimizations.

So if you’re already advertising or looking to get started, call them up and simply ask them for this info.

Presentation

Check recent presentations that your competitors have done at conferences, meet-ups or webinars. They won’t spill the beans completely but they’ll often leave clues. This allows you to piece together the info you need.

Sometimes an innocent-looking tweet can be the key you need.

Networking

I’ve attended many conferences where I have run into chatty vendors or (ex) employees that share a little too much information. So listen closely when you bump into someone interesting. (This works extremely well during the drinks part of live events 🙂

Benchmarks

If you don’t have a clue about which metrics you should be hitting and are getting nowhere by spying on your competitors, have a look at these ecommerce benchmarks.

For an example of how this approach works, check out my analysis of the Google Ads strategy from Allbirds:

Competitive PPC Tools

I’ve mentioned a couple of tools in this article. All of the reports and charts I’ve shown before can be had for free. Most of them offer a free plan and paid or pro version that goes into more detail.

Some tools might not be 100% accurate so don’t focus blindly on the numbers they provide.

Use them as indicators to give direction to your efforts:

- Which competitors are on Google Ads?

- Have they recently increased or decreased spending?

- Are there any seasonal trends in their advertising?

- Etc.

So check out the tools below and find one that fits your style:

- Similarweb – broad tool with plenty of free data

- SEMrush – solid PPC tool with international support

- Ahrefs – amazing tool for SEO, capabilities as a PPC tool are pretty limited.

- iSpionage – PPC tool with a pretty limited free plan

- SpyFu – the most accurate tool from our little experiment. Google Ads advisor offers you actionable insights